The recent platform advancements are aimed at automating parts of the value chain, potentially reducing the volume of traditional work available to Global System Integrators (GSIs) and intensifying the pressure to acquire specific capabilities. A few specialist Salesforce service providers have been quicker to build these new-age skills through more agile, hands-on delivery models.

For a provider such as TCS that has historically anchored in large-scale implementations and has gone down an organic route, the competitive gap risk has become more visible as the market demands agility and advisory depth. In this environment, acquiring specialist providers has become one of the preferred ways to enable GSIs to remain competitive and relevant in a rapidly maturing Salesforce ecosystem.

Reach out to discuss this topic in depth.

How does Coastal Cloud fit?

The broader Salesforce ecosystem is shifting toward engagements that require strong advisory capabilities, industry-specific expertise, and multi-cloud integration capabilities. Coastal Cloud operates a consulting-led model targeting mid-market. Its strengths lie in industry-focused advisory and expertise across multiple clouds, with good focus on business-led Salesforce modernization.

Gaining consulting depth and AI-focused capabilities is not easily achieved organically at the pace the market now demands for traditional GSIs with an implementation-focused heritage. Amid this shift, TCS’ acquisition is about enhancing the advisory muscle and strengthening Salesforce capabilities needed for driving the next phase of platform-led transformation.

This deal reinforces TCS’ strategic posture across several dimensions:

- Expanded access to the Salesforce mid-market segment – Coastal Cloud brings a strong portfolio of mid-market Salesforce clients, a segment that remains less saturated than large enterprises. This strengthens TCS’ market reach beyond its presence in large enterprise segments and creates an additional growth vector over the next three to five years.

- Enhanced Salesforce talent pool and certifications – ListEngage and Coastal Cloud collectively add over 700 certified Salesforce professionals. This enhances TCS’ Salesforce delivery capacity and provides greater flexibility in managing complex engagements in a constrained talent market. It brings additional capabilities across key Salesforce modules including Agentforce, Marketing Cloud, and Commerce Cloud.

- Strengthened industry-aligned Salesforce capabilities – The acquisition allows TCS to deepen its Salesforce presence in sectors where it already has a strong position, such as healthcare and Life sciences , financial services , and manufacturing, while expanding into education, professional services, nonprofit, retail, and the public sector, where Coastal Cloud has established practices.

Market implications for this acquisition

This acquisition reflects a broader structural trend of consolidation across the Salesforce services ecosystem. We are seeing signs that the Salesforce services market is consolidating among larger players. From our market analysis, the top ten providers’ share has increased from roughly one-third of the market in 2020 to about half by 2025, and our client conversations also point to ongoing vendor consolidation.

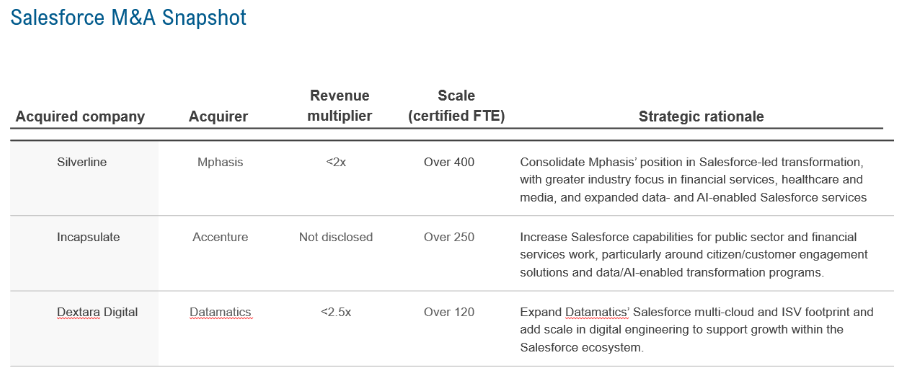

As shown in Exhibit 1, recent Salesforce-focused acquisitions such as Mphasis–Silverline, Accenture–Incapsulate, and Datamatics–Dextara illustrate the broader consolidation trend in the Salesforce services ecosystem.

This pattern reflects a maturing Salesforce ecosystem and rising expectations around scale, integration, and outcomes. For Salesforce customers, this means a market dominated by a relatively smaller set of large, integrated providers and gradually shrinking choice among pure-play specialists.

Another notable call-out of TCS’ acquisition is that it is reportedly paying around 5x revenue multiple for Coastal Cloud, which is at the higher end of recent Salesforce services deal valuations and relatively above typical market benchmarks. This premium reinforces the message that high-quality, Salesforce-native assets are becoming scarcer and more expensive. Here assets refer not just to talent, but also to embedded IP, delivery accelerators, and established client relationships that specialists such as Coastal Cloud bring to the table. These capabilities are increasingly difficult to replicate organically, which are likely to lift valuation expectations for other attractive Salesforce-focused targets.

As the leading GSIs increasingly take a central role in Salesforce-led transformation, further selective acquisitions are likely as providers seek to strengthen capability depth and access to talent. The key question now is: which providers will be able to convert this Mergers & Acquisition (M&A)-led expansion into a durable, differentiated position in the Salesforce services market?

At EPS, we track the Salesforce services market in depth, reach out to us to discuss further.

If you found this blog interesting, check out, Salesforce’s Agentforce 3: A Bold Bet on Enterprise-Grade AI Agent Management | Blog – Everest Group Research Portal, which delves deeper into another topic relating to Salesforce.

We would welcome your opinions on these movements and for any queries, please reach out to Sangamesh Kadagad ([email protected]), Yugal Joshi ([email protected]) and Srinidhi Arunachalam ([email protected]).