Reach out to discuss this topic in depth.

What happened and why now

This acquisition reflects the convergence of two strategic journeys, Coforge’s continued use of acquisitions to be a full-stack, Artificial Intelligence (AI)-focused services provider, and Encora’s sponsor-backed transition from an engineering-heritage firm toward a more enterprise-grade, scaled provider:

- For Coforge: engineering-led scale as the backbone of a full-stack AI ambition: Coforge’s inorganic strategy reflects a deliberate “string of pearls” approach, with acquisitions aimed at adding complementary capabilities that expand its relevance in higher-value enterprise spend. The acquisition of Cigniti strengthened lifecycle assurance capabilities, while Encora represents a more material step toward scaled engineering and product development. Through the Encora acquisition, Coforge is reinforcing engineering as a core execution layer to deliver AI-led outcomes across data, cloud, platform-led modernization, and broader enterprise transformation initiatives

- SPES represents an attractive adjacency, given its structurally stronger growth profile, with the market expected to grow at approximately 5.5–6.5% Year on Year (YoY) through CY25–26, compared with ~3% growth for the broader IT Business Process (IT-BP) services market, making it a logical contributor to Coforge’s medium-term growth ambitions

- Post-acquisition, the combined entity is expected to demonstrate a more balanced capability mix across AI-for-engineering and engineering-for-AI. While both organizations have invested in AI-enabled software engineering, Encora materially strengthens the engineering-for-AI dimension, enhancing differentiation in enterprise modernization and AI-centric programs

- For Encora: sponsor-backed scaling with continued alignment to the combined platform: Encora has been on a private-equity-backed journey to scale beyond a pure engineering-services positioning and move toward a more enterprise-grade posture, signaled by leadership transition around 2023. While sponsor-backed firms typically pursue monetization pathways over time, this transaction is structured to retain alignment, with Encora’s shareholders continuing to hold a meaningful minority stake (approximately 20%) in the combined entity

Why this acquisition works – moving Coforge’s center of gravity

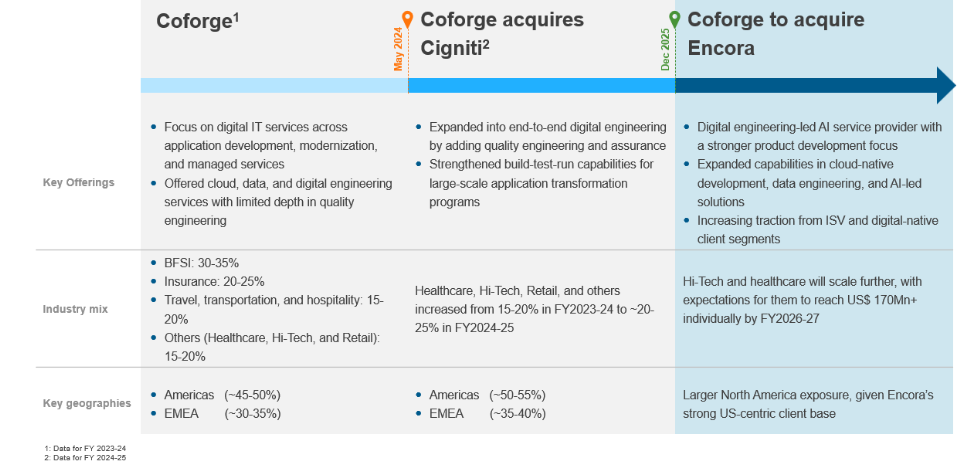

At its core, the Encora acquisition works because it shifts Coforge’s center of gravity toward strategic direction. Exhibit 1 captures this shift across offerings, industry mix, and geography focus:

Exhibit 1: Coforge’s portfolio evolution through acquisitions

- Offerings – from lifecycle completeness to higher-value engineering depth: The acquisition strengthens Coforge’s digital engineering and product development capabilities, particularly in cloud-native development, data engineering, and AI-led solutions, as highlighted in Exhibit 2. This tilt toward engineering- and product-centric work also improves unit economics, with Encora operating at higher margins and delivering ~US$74,000 revenue per employee, compared with ~US$69,000 for Coforge, creating a clearer path to profitability uplift as the portfolio mix shifts toward higher-value engineering programs

Exhibit 2: Expansion of product and application engineering capabilities through Encora, as showcased across Everest Group PEAK Matrix® assessments

- Industry mix – rebalancing toward healthcare/hi-tech: The acquisition is poised to further increase the revenue share of their Hi-Tech and healthcare industry practices, with conservative estimates pegging both verticals at ~US$ 170Mn individually by 2027

- Geography focus – stronger presence in key US markets: The acquisition further strengthens Coforge’s footprint in North America, with increased emphasis on the US West and Midwest regions, where Encora has established client relationships and engineering-led engagements

- Delivery footprint – expanding near-shore capacity in Latin America: Encora also adds near-shore delivery capacity in Latin America, enhancing Coforge’s delivery model for engineering- and product-centric work. This strengthens Coforge’s ability to support programs that benefit from closer time-zone alignment, faster iteration cycles, and tighter collaboration, capabilities that are increasingly important in AI-led and product engineering engagement

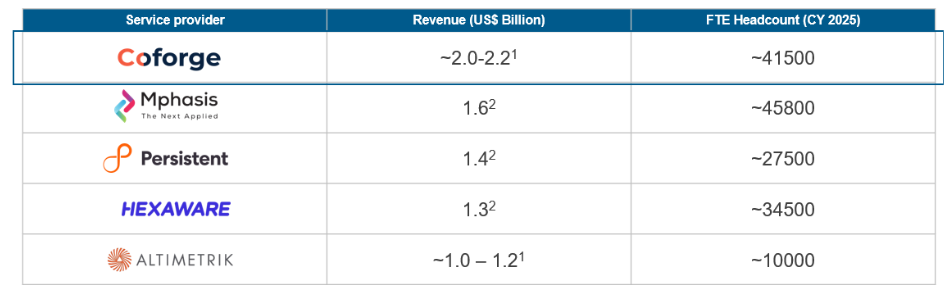

- Scale – leapfrogging the mid-tier peer set: Encora adds meaningful scale to Coforge’s platform, with ~US$600 million in revenue and a ~8000 employee base. Post-acquisition, Coforge emerges as a ~US$2 – 2.2 billion revenue player with ~41,500 FTEs, placing it well ahead of several mid-tier peers on scale alone, as illustrated in Exhibit 3

Exhibit 3: Scale comparison across select mid-tier provider set

The path ahead

While the strategic rationale for the acquisition is compelling, the success of the Coforge – Encora acquisition will ultimately be determined by execution. In our view, the key risks are less about deal mechanics and more about how effectively Coforge integrates, positions, and operationalizes the combined portfolio without diluting the very strengths it is acquiring.

- Operating model and cultural alignment: Encora brings an operating model optimized for speed, autonomy, and deep technical ownership (as necessary for high-stake product engineering). Integrating this into a scaled enterprise Information Technology (IT) services organization without over-governing delivery or slowing execution will be critical to preserving Encora’s engineering edge. In addition, the coming together of these two entities may bring operational and cultural integration challenges given the acquired entity is almost one-third the size of the acquirer (unlike most tuck-in acquisitions where the former is expected to naturally get absorbed into the larger entity)

- Go-to-market clarity and positioning discipline: Post-acquisition, Coforge will span digital transformation, quality engineering, and deep engineering services. The risk lies in an ‘everything-to-everyone’s narrative. Clear prioritization around AI-led engineering as the execution backbone for full-stack enterprise transformation will be essential to drive recall, pricing power, and larger sole-sourced opportunities.

Outlook and conclusion

The Coforge – Encora acquisition reflects a broader shift underway in the services market, particularly among mid-tier providers, driven by structural changes in enterprise demand. As AI becomes embedded into core engineering workflows, enterprises are consolidating services spent with partners that can deliver deep execution expertise across engineering, data, and cloud stack, raising the relevance threshold for service providers and pushing mid-tier firms to rethink how they scale capabilities and credibility.

Against this backdrop, two developments are becoming increasingly visible in the market:

- Mergers & Acquisition (M&A) is becoming a prominent strategic lever in a growth-constrained market: While few large System Integrators (SIs) such as Accenture have relied on acquisitions to scale and expand capability areas and will continue to do so, mid-tier providers and even traditionally conservative acquirers are increasingly adopting targeted inorganic plays. Recent transactions such as Altimetrik’s acquisition of SLK Software and Coforge’s acquisition of Encora underscore this trend. Even TCS, which has not been a regular buyer, has pursued select acquisitions in 2025, including the acquisition of US-based Salesforce specialist ListEngage and the agreed purchase of Salesforce consulting firm Coastal Cloud, signaling a renewed emphasis on boosting select capabilities through inorganic means

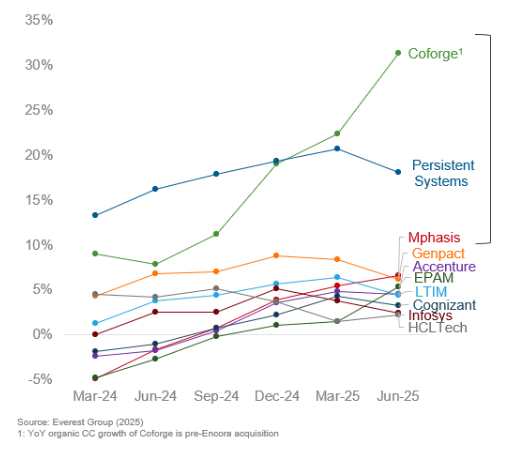

- Mid-tier providers are getting aggressive, growing faster, and challenging larger SIs: Various mid-tier services providers are consistently outperforming larger peers on growth numbers, even in a muted macro environment as illustrated in Exhibit 4

Exhibit 4: Y/Y organic constant currency growth of top 10 service providers

If you enjoyed this blog, check out our recent report, Provider Snapshot | Coforge 2025 – Everest Group Research Portal, which delves deeper into another topic relating to Coforge.

If you have any further questions, please contact Ankit Gupta ([email protected]), Akshat Vaid ([email protected]), Ankit Nath ([email protected]) and Anurag Mukherjee ([email protected]).